Self Directed 401k

Enterprise™ Self Directed 401k C-Corp

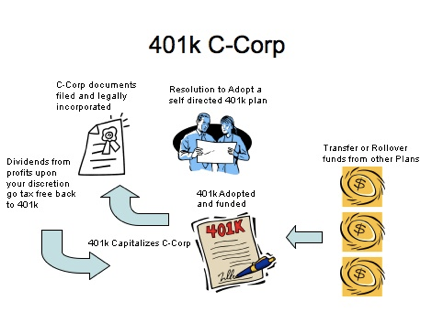

The self directed 401k sponsored by a C-Corp. is a product that is designed to help you fund a new business or existing business with retirement funds. This model allows you the CEO of the company to determine if and how much of the corporation should be with 401k dollars.

This model must utilize a C-Corp. structure to maintain compliance for this purpose. No other structure has the ability to issue shares and maintain compliance with the IRS code. For example, retirement funds are prohibited to invest in Sub Chapter S corps even though they offer shares.

What Your Plan Comes With

Favorable determination letter from IRS

Favorable determination letter from IRS Setup of C-Corp

Setup of C-Corp Filing of state articles by AES

Filing of state articles by AES Filing for Corp EIN with IRS by AES

Filing for Corp EIN with IRS by AES C-Corp bylaws

C-Corp bylaws Setup and operating guide

Setup and operating guide Stock certificates

Stock certificates Meeting Records (initial and annual)

Meeting Records (initial and annual) Banking authorizations for checking account

Banking authorizations for checking account Creation of 401k plan documents

Creation of 401k plan documents Filing of 401k EIN

Filing of 401k EIN Complete set of plan documents with all necessary forms and guides

Complete set of plan documents with all necessary forms and guides Assistance and guidance in the rollover of current plan to new self directed plan

Assistance and guidance in the rollover of current plan to new self directed plan Assistance and guidance in setup of checking account or use our partner bank

Assistance and guidance in setup of checking account or use our partner bank Unlimited Advisor consulting for plan setup and operation consulting for plan setup and operation

Unlimited Advisor consulting for plan setup and operation consulting for plan setup and operation

How it Works

Setup Process

Create the entity; C-Corp. Our attorneys will create the entity with the appropriate state

Create the entity; C-Corp. Our attorneys will create the entity with the appropriate state Create the Plan (Trust with Plan documents). Our attorneys will create the plan and file with the IRS

Create the Plan (Trust with Plan documents). Our attorneys will create the plan and file with the IRS Rollover monies from IRA or 401K to your self directed 401k

Rollover monies from IRA or 401K to your self directed 401k Setup Checking Accounts for the Company and the Plan

Setup Checking Accounts for the Company and the Plan Make direct Investments by purchasing membership or stock in a company – your C-Corp or another company

Make direct Investments by purchasing membership or stock in a company – your C-Corp or another company